Boulder Real Estate News

September Market Update

Fed Funds Rate vs. Mortgage Rates: Know the Difference

The Fed Funds Rate is what banks charge each other for overnight loans. When the Fed lowers it, things like credit card rates and personal loans might drop, but it doesn’t directly affect mortgage rates. Mortgage rates are influenced by bigger factors like inflation, unemployment, and overall economic health. A cut in the Fed Funds Rate doesn’t mean your mortgage rate will drop right away—it depends on the broader economy. Understanding this can help clients make smarter decisions in today’s market.

Let’s take a quick dive into last week’s happenings

Inventory and Buyer Activity -The market’s been a bit of a rollercoaster lately, but guess what? Last week was better than expected. Showings went up, deals got done. Despite all the noise, people are still buying.

A Buyer’s Opportunity – Buyers, now’s your moment. You’ve got options—more than you’ve had in years. Sellers are ready to make deals—repairs, concessions, you name it. Don’t wait around. If rates drop, the feeding frenzy will start, and your leverage disappears. Inventory is trending We’ve got more homes on the market than last year, and “coming soon” listings are ticking up. More inventory is on the way—stay sharp.

Local Market activity: Pending sales held steady, but inventory is up compared to last year. Translation: buyers have the edge. But, the Odds of Selling dipped slightly, showing the market’s a bit sluggish for this time of year. Showings & Time on Market showings are up, both from last week and last year. Homes are taking longer to sell, giving buyers more breathing room. Take your time, but don’t sleep on a good deal.

Price Reductions:

Sellers aren’t slashing prices like crazy—they’re adjusting. They know what’s up, and so should you.

August Market Update

An increasing focus on buyer opportunity

There’s an increasing focus on buyer opportunities right now. Why?

We’re seeing almost 40+% more inventory than this time last year, which is closer to pre-pandemic levels. For context, that’s about 2.6 months’ worth of inventory. The % of homes having price decreases is also about 45% – this is why I’m highlighting a unique perspective here: buyers who have been looking for a market shift/adjustment for the past several years have the opportunity right now, as do the rest of buyers anticipating an uptick in buying power with a rate decline.

With more inventory available than we’ve seen in ten years, sellers are increasingly willing to negotiate, make repairs, offer concessions, and accept contingent offers. This is a phenomenal time for buyers to make a move they might not have been able to make in a long time. It’s important to understand that you have more negotiating power as a buyer, especially before potential rate drops bring more competition back into the market.

Here’s a quick overview of what the market activity for the past week few weeks of August has been:

-The average daily active count remained relatively steady, with a slight decrease. Inventory levels are significantly higher than this time last year.

– New listings saw a small decrease from the previous weeks but are up slightly compared to one year ago.

– Showings increased slightly, with an average of 1.4 shows per property.

– The rate of price reductions held steady, with nearly half of the properties going under contract after a price cut.

– As we move deeper into August, the market typically cools as families settle into the back-to-school routine. This period is prime time for buyers to secure a great deal with motivated sellers. This may fuel the anticipated “growth” I mentioned last month, it may not.

The good news is that mortgage rates are at their lowest point for the year, right now it looks like just under 6.5, maybe 6.375. In general, people in the market or those wanting to be in the market will take note of what sort of signal comes from the Fed in Sept regarding interest rates. What the public may not totally understand either, is that the markets have been “hedging” the fact that the Fed will reduce rates. In short, they’ve been slowly coming down “ahead” of the Fed enacting any sort of monetary rate cut. So, when the Fed does drop the federal funds rate in Sept, Nov, or December, it won’t be surprising to see a modest, and slow movement of market rates in general.

Compared to this time last year, appreciation seems to be slowing given the shortage in demand and elevated quantity of inventory. Expectations to sell a home in under 30 days should be tempered given what we’re seeing in the number of listings with price reductions. Based on all the factors that the housing market is facing, it seems like “stability” is the key word to describe what to expect for the rest of 2024, even with a potential rate decrease by the Fed in September.

Sellers: “Turnkey” is the core of how to approach setting up your home sale for success – see note below in July Outlook. Reach out if strategizing with all these factors would be helpful!

More CPI data in August reinforcing the downward trend of inflation will be critical to how the Fed positions itself in September.

– Understanding The Market –

My approach to real estate involves strategy to position you for life’s changes plus setting you up for future economic security. I do this by being a resource long before, during, and after the opportunity to work with you. That’s why I put an immense amount of effort into understanding and delivering information that will help position you to take on the market and any transaction you find yourself in. Interested in discussing more? Connect > Craig.David@WestAndMain.com

July Update

Some data shows signs of inflation continuing to trend down, along with a slight “cooling” factor on the economy within the services and labor markets. The thought is that this will eventually complete the “soft landing” along with moving into a more balanced and normalized market.

Properties that are considered “turnkey” (move-in ready with little or no maintenance) are the preferred purchase of the summer. Why? Because buying power still remains a concern even though people need to move and rates have come down (slightly to 6.5-6.625).

176 days left in 2024: The market is anticipating 5-10% sales growth, due to more sellers in the market and a higher percentage of cash buyers. So, simplified …the market as a whole, is trying to grow. And, if the Fed drops rates in September, we’ll see all those 1st time and mid-range buyers come off the sidelines. It’s also anticipated by many economists that we may anticipate more of this going into 2025 as affordability through buying power increases. In the meantime, this equals a GREAT buyer opportunity with fewer buyers active at the moment.

June Update

2024, The Year of Rising Inventory + A Throttled Economy

I’m not sure about you, and what you’re seeing, but it seems like the US economy is just this phenomena right now. We’ve weathered inflation, data shows that real estate prices bottomed out last summer, and we all assumed higher interest rates would have slowed down or dampened the economy – this is at its core, one of the key principles of economics: limit access to capital to cool things down.

One hypothesis of why the economy seems to be SO resilient is that given the acceleration in interest rates, there is potentially more money in short-term money market investments than there is consumer debt owed. Essentially, the idea is people are making more in interest on their money market funds (short-term deposits) which are out-performing or greater than the incremental costs of higher interest rates, which theoretically puts more money in your/our pockets.

I know, let’s break that down: higher interest rates may be fueling stimulation to the economy.

Crazy  .

.

May Update – Supply & Demand

We all may or may not have had economics in our schooling, however, I’d be willing to be we at least understand what effect supply and demand can have on macro-level economics, am I right?

Just recall a few short years ago when Covid hit and TP was at an all-time high demand – i mean, lifetime high on the demand scale. What happened? People hoarded it and the supply in circulation went wayyyyy down.

This concept plays out in many aspects of our life daily. Below I jump in front of a camera and give you a quick update on how all this relates to the market, you, and your dreams of homeownership whether you’re buying or selling.

March 20th Update

More Inventory, Stable Prices + A Soft Landing

Hold onto your hats because we’re about to hit you with fresh market insights to make your head spin. Are you ready?

Sellers are finally stepping up to the plate. In the week ending March 16, we saw a jaw-dropping 17.8% surge in new listings compared to last year. I mean, that’s the kind of growth rate that hasn’t been seen in nearly three years. It’s like sellers suddenly woke up and smelled the coffee.

But here’s the kicker: Where are the buyers? It’s like they’re playing a game of hide and seek, waiting in the wings for the Fed to make a move on lowering rates. And can you blame them? Lower rates mean lower borrowing costs, and who doesn’t love a good deal?

Now, let’s talk economics 101. Supply and demand. When rates are up, inventory is up. When rates go down, inventory goes down. Simple math, right? But here’s the thing, the market still needs an extra 10-12 weeks of additional supply to really hit its stride. So, when rates start to drop, brace yourselves because we could see a flood of buyers hitting the market for those quick deals.

And speaking of the Fed, let’s give ’em three cheers because they held rates steady but stuck to their guns on those three rate cuts this year. And you know what happened? Traders went wild, sending the stock indexes soaring to record highs. But hey, the economy’s still giving us mixed signals. Manufacturing activity in the Philly region took a bit of a hit in March, weekly crude oil inventories are down, signaling increased demand and higher prices.

And let’s not forget about jobs. Initial weekly jobless claims? Way below recession levels. And the Leading Economic Index for February? Still remains in positive territory. Given the healthy levels of consumer’s balance sheets right now, most economists point to gliding into a soft landing. Again, three cheers – weathering the storm of the last 3 years is incredible.

Now’s the time to suit up and get in the game because of the housing market. It’s heating up, and you don’t want to miss the opportunities.

February 7th Update

The optimism in the market remains high, however, after last week’s FED meeting, the market is anticipating a slower on-ramp to any rate decreases the FED may take. Mortgage rates rose about .4% after the news. This seems like a rather normal response, given how much anticipation was built up for a Feb rate decrease. It has, however, set the stage for what looks to be a conservative approach from the Fed, and an estimate of three (3) rate decreases in 2024.

The market is feeling it, mortgage applications are up, and across the board, there are roughly an extra 5M buyers in the market right now.

Spring selling season prediction: Strong.

-New listings rose 16.4% in January YoY, not typical

-Under contracts rose 6.2% in Jan YoY

-Median closed price rose 5.3% in Jan Yoy

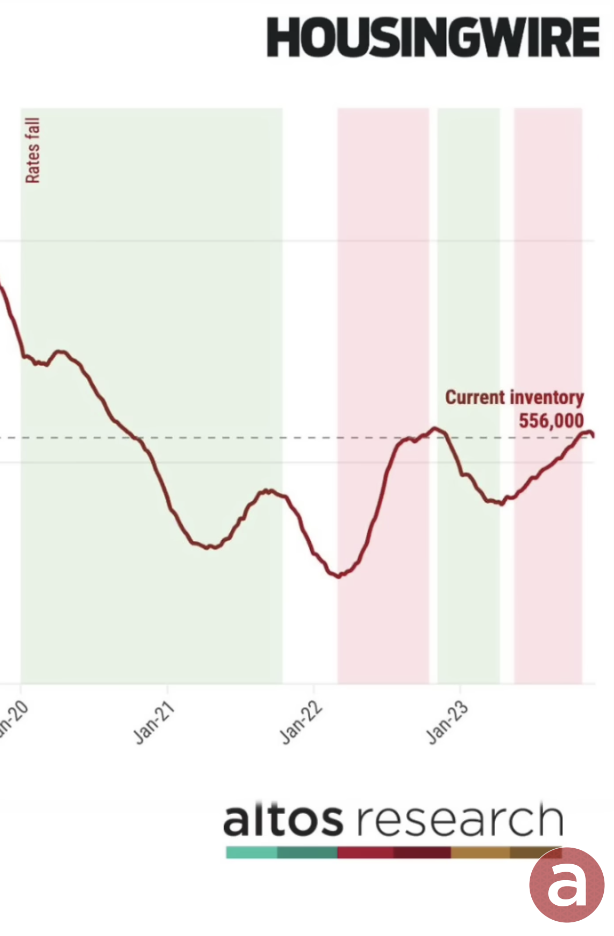

According to Altos Real Estate Research, the housing market already experienced its bottom last fall. With increasing consumer/buyer confidence, plus a slowly increasing supply of homes, they are signaling spring/summer is ideal for buyers before prices begin to rise again and Summer/Fall for selling when demand is at its highest.

January 20th Update

Looking at where we’ve come from in 2023, to the horizon of 2024, the landscape of the real estate market presents both a few unique challenges and exciting opportunities. The National Association of Realtors (NAR) forecasts a revitalized real estate environment with 4.71 million existing home sales, signifying a significant upturn from the previous year. I aim to equip our community of savvy, forward-thinking homeowners and investors with insights to navigate this market with peace of mind. Let’s explore how to turn the outlook into positive moves within our local market.

2024’s real estate market is shaping up to be a landscape of moderate growth and stabilization. According to NAR’s predictions, we’re looking at a 13.5% increase in home sales compared to 2023. However, median home prices are expected to remain steady nationwide, which makes affordability an ongoing issue. Boulder and Colorado as a whole continue to be a textbook example of the dynamics of supply and demand.

A key factor in the 2024 market is the forecasted average 30-year fixed mortgage rate of 5.5% to 6.3%. Although this is higher than historical lows, this rate becomes more manageable for people interested in a 2nd/vacation home along with investors looking to finance property purchases. The overall U.S. GDP growth, projected at 1.5%, suggests a steady, if not explosive, economic climate, avoiding a recession.

Even though these economic predictions are coming early, and before the Fed has decreased the benchmark, indicators imply a more predictable market moving into the 2nd 1/2 of 2024 and 2025. The stable economic conditions and low foreclosure rates (below 1% of all mortgages) offer a safer investment landscape. This environment is conducive to making wise, long-term decisions with the ability to leverage knowledge and patience to make informed decisions.

Additional economic data should put the market at ease: Traders got enough positive economic data to foresee a soft landing for a slowing economy, as December Retail Sales, weekly jobless claims, and Housing Starts all came in stronger than expected.

Zillow found that in Q4 of last year, 21% of homeowners were considering selling their homes in the next three years, up from 15% a year ago—another sign inventory should start to show some improvement across the board.

And last week, trading was UP AGAIN. The three major stock indexes rose sharply on Friday, finishing the four-day trading week solidly ahead, as the broadly-based S&P 500 set a new record high for the first time in more than two years. Crazy, the momentum seems to keep moving right along.

– Understanding The Market –

My approach to real estate involves strategy to position you for life’s changes as well as setting you up for future economic security. I do this by being a resource long before, during, and after the opportunity to work with you. That’s why I put an immense amount of effort into understanding how the market may affect you while building strong, lasting relationships with fellow industry professionals who I trust and feel good about referring. Reach out HERE for a chat!

*Data and economic opinion courtesy of NAR, Realtor.com, GreenLight Mortgage Group, First American Title, The Real Estate Economy – Chief Economist Mark Fleming, Ph.D, and CBS Economic commentary.

*This content is also provided as a courtesy to additional thought and conversation. In no way am I, Craig David, an economist.

December 18th Update

* I’m cautiously optimistic about the news over the last few weeks. However, last week rates moved sharply downward after the Fed signaled the potential of rate cuts next year amidst positive economic news.

*Core inflation readings for PPI & CPI came in near expectations, down slightly to an inflation # of about 3.1% (down from 3.6%). This news plus the Fed’s statements led analysts to predict that the Fed could cut rates as many as three times next year – a shift from the earlier weeks’ projections of six times.

*The Dow hit a new high surpassing 37,000 after this news.

*The yield on 10-year treasures dropped below 4% for the first time since August.

Is it possible we’ll see the soft landing? It’s looking like it, however, the first quarter of 2024 should tell more of the story.

December 6th, 2024 Update

Federal Reserve will cut interest rates 6 times in 2024 as the economy shows clear signs of cooling down, ING says

An economy that is showing clear signs of decelerating means the Federal Reserve will cut interest rates at least six times in 2024, according to a Thursday note from ING Economics.

Moderating inflation, a cooling jobs market, and a deteriorating outlook for consumer spending mean the Fed may need to cut interest rates more than the market expects.

“We have modest growth and cooling inflation and a cooling labor market — exactly what the Fed wants to see,” ING’s chief international economist, James Knightley, wrote. “This should confirm no need for any further Fed policy tightening, but the outlook is looking less and less favorable.”

Knightley says he expects the Fed will start cutting interest rates in the second quarter of next year, delivering as many as six 25-basis-point rate cuts totaling 150 basis points. He also says that he expects the interest-rate cuts to extend into 2025 with at least four 25-basis-point interest-rate cuts. Meanwhile, the futures market suggests the Fed will cut rates by 125 basis points next year.

Knightley’s expected rate cuts would bring the effective Federal Funds rate to about 3.83% at the end of 2024 and to 2.83% at the end of 2025, compared with today’s Fed Funds rate of 5.33%.

Those rate cuts should prove stimulative to the economy over time, but not immediately. Changes to the Fed Funds rate often come with a lag of between 12-18 months before they are felt.

The gradual interest-rate cuts forecast by Knightley are encouraging because they suggest that the economy will remain resilient and that the Fed won’t be forced to cut interest rates to 0% immediately, as they tend to do when the economy significantly decelerates and enters a recession.

Knightley highlights that while the job market remains solid, evidenced by weekly jobless claims that remain in the low 200,000 range, it has noticeably cooled.

“Continuing claims surged through to 1,927k up from 1,841k. There have been questions over seasonal adjustment issues and data volatility, but the trend is certainly towards higher continuing claims while initial claims remain low. Essentially, the message is that firms are reluctant to fire workers, but they are less inclined to hire new workers. i.e. more evidence of a cooling, but not collapsing, labor market,” Knightley wrote.

Meanwhile, consumer spending, while solid, faces a tougher road ahead in 2024 as real household disposable incomes show signs of weakness, credit card delinquencies rise, and student-loan payments add further strain.

“The data suggests stagnant real household incomes over quite some time now. So far, this has been offset by the running down of savings and the use of debt to fuel spending growth,” Knightley said.

“However, tighter credit conditions and high borrowing costs are likely to weigh heavily on the flow of credit to the household sector while there is growing evidence of pandemic-era accrued excess savings being exhausted for an increasing number of people,” Knightley said.

This all chalks up to an economy that’s on thin ice but hasn’t broken yet. And it might not break if the Fed can successfully lower interest rates before the economy enters a recession.

Otherwise, a broken economy probably means that the Fed won’t be so patient with cutting interest rates. UBS expects the Fed to cut interest rates by a whopping 275 basis points next year in response to a recession.

Market updates will be added as we see the Fed make decisions later in the year and start to see how 2024 home trends play out in January!

Read more at BusinessInsider.com &