Demand Continues + The Gift of Choice

While Halloween is behind us, some still feel a bit spooked by what may lie ahead when it comes to buying and selling homes in Boulder and Denver alike.

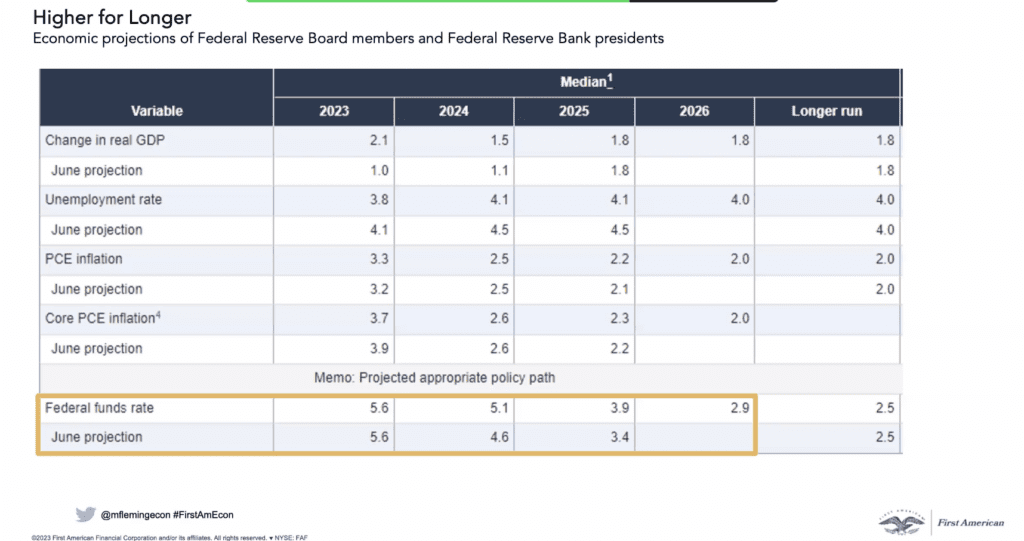

And despite the shifting market and general uncertainty, people are still buying and selling homes. We’re actually seeing a slight increase in inventory compared to this time last year, up slightly by 2.63%. Additionally, the market is starting to realize rates may be here to stay for a little bit longer. That’s at least how Federal Reserve Chairman J. Powell put things; which, if you consider the aggressive previous 18 months’ worth of rate hikes, this is a bit of a relief.

“How so?” you may ask. Let’s put some additional context here.

- The Fed’s unanimous vote to pause any rate hikes supports longer-term adjustments needed to allow inflation to come down and work its way through the markets

- Based on Powell’s comments last Wednesday, the markets are anticipating an 85% likelihood the Fed will NOT raise rates in December (see above)

- Goods in general are in a deflationary state, which may take more time to make its way to consumer goods

- Shelter inflation (cost of housing/equivalent rents) is anticipated to normalize in another 6-9 months

- The labor market is cooling, which will help support the soft landing

The Market

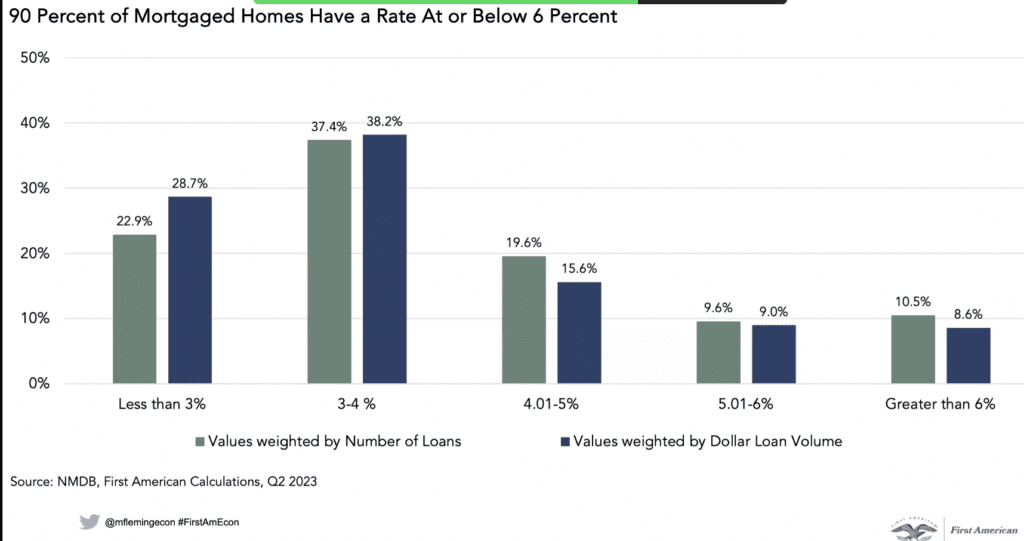

- We’re still experiencing the Golden handcuff effect (see August Outlook)

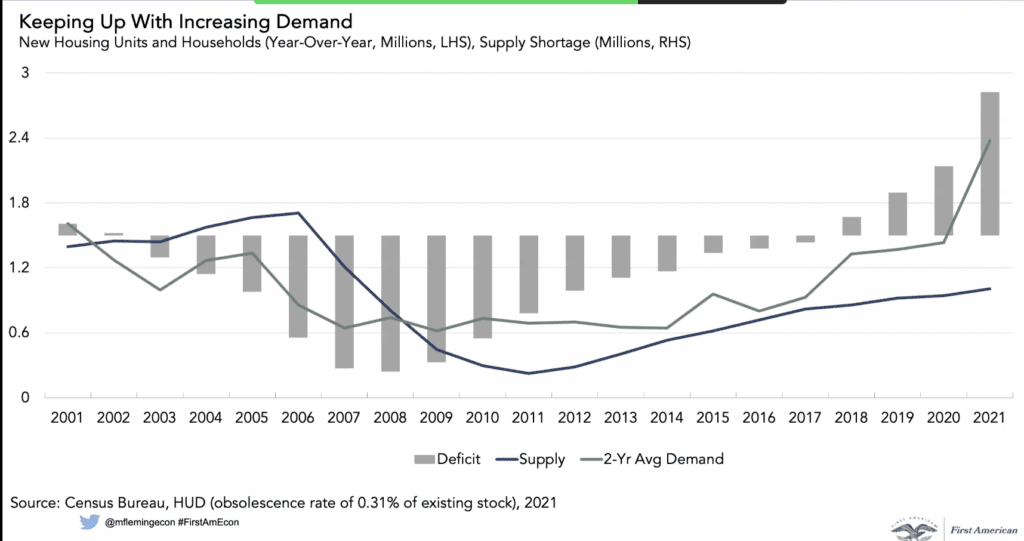

- There is still immense pressure on the housing supply. Of total available housing, we’re seeing about 1% of total available housing nationwide available right now

- New Build homes are where the advantages seem to lie for buyers – both availability + incentives from builders to buy down rates

- The incoming demand from millennials is also fueling the need for additional housing units with ~ 50% of millennials owning and waiting until their early 30’s to buy – that time is happening now

- 42% of currently owned homes are owned “Free & clear” – meaning a large pool of current homeowners have options when it comes to sitting tight and not having household overhead while also having immense equity to transfer into new homes or downsize – be on the lookout for the boomers to be shifting within the market because of this.

What does this all mean to Sellers?

Selling your home in Boulder puts you in a unique position, both from an equity standpoint (at an all-time high), but also in a place that may need an adjustment of reality when considering the current market. Over 60% of homeowners have a rate of 4% or less. However, the pandemic was a perfect storm of low interest rates, unprecedented demand, and the ability to literally work anywhere. As employees are called back to the office and interest rates hover above 7 percent, the party is over (sort of). Pricing your home right, ensuring its turnkey will attract the right buyer and likely several of them.

How about buyers, where are they in all this?

Buyers in Boulder and Denver on the other hand are sitting in a unique position, and some know it. While overall mortgage applications are low, hard money loans are on the rise as well as gifted funds from loved ones to help bridge the gap towards home ownership. This may be surprising, but December home buying is historically a busy time of year, and increasing inventory is finally providing buyers with the gift of choice. Many buyers tend to hibernate for the winter. But for those who continue to look through the holiday season, there is less competition and sellers are usually more motivated to sell before the end of the year.

Truth be told, affordability is a real factor right now for new home buyers in Boulder. For buyers who feel priced out of the housing market, an alternative tactic is to find a roommate or two or have a serious talk with family about them assisting you to get into a home or condo. Non-owner-occupant rental properties are a great option to find a way into the housing market. Regardless of the path, buyers are gaining more control in this market as time goes on.

At the end of the day, properties will continue to trade hands for the right price and terms. Interest rates can be daunting; however, the key is to get onto the escalator of homeownership and experience appreciation as it moves upwards over time.

Is it a good time to buy?

It’s hard to out-save the market, in terms of appreciation and the tax benefits of a home. It truly comes down to your individual situation. If you can find a way in, you’ll be glad you did in 5-10 years.

November 2023 Takeaways

- For buyers in general, know your buying power & options that influence how you can make really smart offers. Ensure your agent communicates w/ the other party’s agent before making an offer

- For first-time buyers, there’s a lot of opportunity with inventory that is 40+ days on the market or has been withdrawn. In any general market, there’s 11-15% of people who need to move because life keeps happening. Find them & make them a reasonable offer.

- Sellers – be smart, know what your local market is doing, and ensure you’re presenting the absolute best. Buyers are savvy and are feeling the pressure of rates.

- Investors – Get creative with a strong offer and dig for the opportunity. If you can weather the rate for the next 12-24 months, now could be the time. Sooner or later when rates go down, prices & competition will rise.

Reach out at – Craig.David@WestAndMain.com – or schedule a time to

discuss your particular situation.

*Market Data sourced from Denver Metro Association of Realtors

*First American Sr Economist

*Change Mortgage Finance

*Federal Reserve Meeting, J. Powell